What are the Key Components When Forecasting Cash Flow in a SaaS Business?

We’re living in a world where subscriptions have become the norm. Gone are the days of buying things outright; now, we pay small monthly fees for access to a wide range of services and products.

From music streaming to meal delivery, subscriptions are everywhere. It’s not just software anymore. You can have unlimited music for the price of a single album or enjoy a vast catalog of movies and shows without buying DVDs.

The rise of subscriptions is no surprise, as they provide affordability, accessibility, and flexibility. In turn, businesses are innovating and exploring new ways to offer SaaS subscription services to meet evolving customer demands.

If you own a SaaS business, you must answer the question, how to forecast SaaS revenue. So projecting SaaS cash flow acts as your roadmap to understanding revenue growth and the key drivers behind it. By accurately projecting future sales and considering SaaS product development cost factors, you can navigate the competitive landscape, make informed decisions, and drive the success of your business.

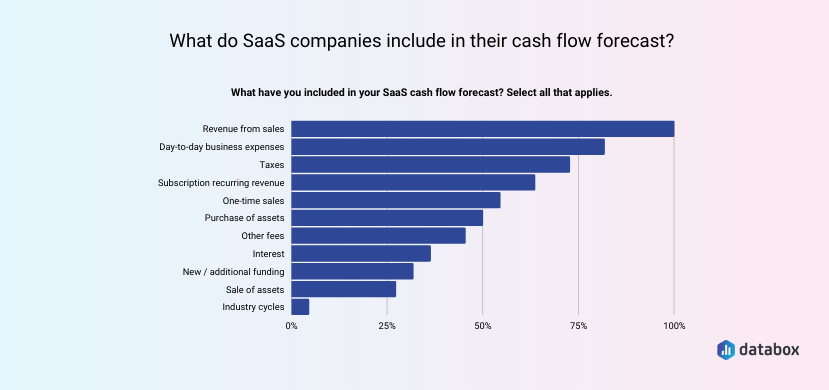

image src :Databox.com

Subscription Metrics

Subscription metrics serve as a window into the health and growth of your SaaS subscription business. You can gain valuable insights by analyzing key metrics to inform your forecasting and decision-making processes. Let’s explore important subscription metrics and how they contribute to your business’s financial success.

The average revenue per user/customer (ARPU)

To estimate your revenue, it is essential to calculate the average revenue per user/customer (ARPU). This metric represents the amount you plan to charge each customer every month. If your business offers different price tiers, consider creating separate forecasts for each tier to gain a comprehensive understanding of revenue potential.

Customer lifetime value (LTV)

By leveraging your churn percentage, you can calculate the customer lifetime value (LTV), which predicts the revenue you expect to generate from each customer over their projected lifetime with your business. To calculate LTV, divide the ARPU by the churn rate:

LTV = ARPU ÷ Churn %

Monthly recurring revenue (MRR)

Last but not the least, monthly recurring revenue (MRR) is a critical component of your SaaS forecast model. Calculate MRR by multiplying the ARPU by the sum of the starting subscribers and new subscribers for a given month:

MRR = ARPU x (starting subscribers + new subscribers)

Churn Rate

In addition to analyzing key subscription metrics, calculating and monitoring your churn rate is crucial. The churn rate represents the percentage of customers who cancel their subscriptions within a given period, giving you insights into customer attrition and its impact on your cash flow. By tracking and managing churn rates, you can identify areas for improvement and implement strategies to enhance customer retention.

Did you know that reducing your churn rate by just 5% can increase your profitability by 25%? It’s an astounding figure highlighting the significance of understanding and addressing churn in your SaaS business.

Let’s take a closer look at your churn rate. What is the average percentage of customers canceling their subscriptions each month? Is it higher than industry benchmarks? Identifying the baseline helps you gauge your performance and set goals for improvement.

To tackle churn effectively, it’s crucial to understand why customers are leaving. Have you analyzed customer feedback or conducted exit surveys to gather insights? This information can be invaluable in identifying pain points and implementing targeted solutions to enhance the customer experience.

Consider implementing customer retention strategies such as personalized onboarding, proactive customer support, or loyalty programs. These initiatives can make a significant difference in reducing churn and fostering long-term customer loyalty.

Monitoring your churn rate over time allows you to track the effectiveness of your retention efforts. Are you witnessing improvements? If not, it may be time to reassess your strategies and make adjustments to address the underlying causes of churn.

Look for Cash Flow to Seasonal Variations

The changing seasons can impact your cash flow. By looking at past data, you can discover customer sign-ups and renewal patterns during different times of the year. This knowledge lets you adjust your projections and prepare for expected cash flow changes.

Think of it like this, certain months or seasons might bring more customers signing up for your service, while others may see fewer renewals. These patterns can be influenced by trends in your industry, customer behavior, or other factors. By analyzing historical data, you can see these patterns more clearly and make smarter projections.

With this understanding, you can make informed decisions to manage your SaaS cash flow better. For example, if you know there might be a slower sign-up period, you can plan marketing campaigns or special offers to attract more customers. Similarly, if you anticipate more renewals during a specific season, you can ensure you have the resources and support to handle the increased demand.

Navigating the Flow of Payments

Payment terms and collection efficiencies are vital when projecting your cash flow. By analyzing historical data, you can uncover valuable insights about how long customers can pay their invoices or renew subscriptions. Let’s explore leveraging this knowledge to improve your cash flow and minimize delays.

Imagine this scenario, you’ve noticed that some customers tend to take a while to pay their invoices, causing a gap in your SaaS cash flow. Now, let’s dive into your historical data. Are there any patterns or trends that emerge? By understanding the average payment timeline, you can identify areas where improvements can be made.

To optimize your cash flow, consider implementing strategies that incentivize prompt payment. For instance, offering discounts for early payment can motivate customers to settle their invoices sooner. Streamlining your billing and invoicing processes, including clear and concise communication, can expedite payments and reduce confusion.

Cyclical Expenses

As a critical part of SaaS financial statements, cyclical expenses play a significant role in cash flow management for SaaS businesses. These recurring expenses occur at specific times of the year, such as annual software licensing fees or seasonal marketing campaigns. Evaluating and considering these expenses in your cash flow projections is thus crucial.

By assessing cyclical expenses, you gain insight into their timing, magnitude, and impact on your cash flow. Understanding when these expenses occur allows you to align your cash inflows and outflows more effectively, ensuring sufficient funds are available when needed. Failure to account for cyclical expenses can lead to cash flow gaps or strain on your financial resources.

External Factors

When projecting your cash flow, assessing external factors influencing your financial health is crucial. You can adapt your projections and strategies to ensure financial stability by staying informed and considering these external influences.

- Market Trends: Keep a close eye on industry trends affecting your cash flow. For example, emerging technologies, shifting customer preferences, or new competitors can impact customer acquisition or retention rates. By monitoring these trends, you can make informed decisions and adjust your business cash flow projection.

- Economic Conditions: Economic conditions play a significant role in shaping consumer behavior and purchasing power. Inflation, interest rates, or economic downturns can influence customer spending and ultimately impact cash flow. Stay informed about macroeconomic indicators and adjust your projections to reflect potential changes in customer behavior.

- Regulatory Changes: Changes in regulations or compliance requirements can directly impact your business operations and revenue streams. Stay current with any regulatory developments affecting your industry or pricing structure. Adjust your projections to account for potential costs or operational changes resulting from regulatory compliance.

- Customer Acquisition and Retention: External factors can directly influence customer acquisition and retention rates. For example, changes in the competitive landscape, technological advancements, or shifts in customer preferences can impact your ability to attract and retain customers. Stay vigilant, understand your target market, and adapt your strategies to meet evolving customer needs.

- Pricing and Revenue Models: External factors can influence pricing strategy and revenue models. Factors such as changes in market demand, competitor pricing, or introducing new products or services can require adjustments to your pricing structure. Monitor the market landscape and be prepared to make necessary changes to optimize revenue generation.

Regular Review and Adjustment:

Regularly reviewing and adjusting your cash flow projections are essential for maintaining accurate financial forecasts. Monitor key metrics such as revenue, expenses, cash inflows, and outflows. Compare your actual performance against projected figures to identify any deviations or discrepancies.

This ongoing assessment allows you to refine your projections and achieve SaaS product-market fit. You can adapt to changing market conditions, emerging opportunities, and unforeseen challenges by staying agile and responsive. Regular reviews ensure that your cash flow projections remain up-to-date and reflect your evolving business dynamics. This iterative process empowers you to make informed decisions and maintain financial stability in an ever-changing business landscape.

Seek Professional Advice

If projecting cash flow becomes challenging, it is beneficial to seek the guidance of financial professionals, such as accountants or business advisors with expertise in delivering exceptional SaaS software development services.

These professionals can provide valuable insights and support in accurately projecting your cash flow. They possess a deep understanding of accounting standards and can ensure compliance while offering advice on optimizing your projections.

Their expertise can help you navigate complex financial scenarios, identify potential risks, and make informed decisions to enhance financial stability. Collaborating with financial professionals empowers you to leverage their knowledge and experience, ultimately strengthening the accuracy and reliability of your cash flow projections.

The best way to manage saas subscriptions is by incorporating these factors into your cash flow projections, you can develop more accurate forecasts and make informed decisions to optimize your SaaS subscription business’s financial health.

The Final Verdict

“One of the earliest lessons I learned in business was that balance sheets and income statements are fiction, cash flow is reality.” – Chris Chocola, American businessman, lawyer, and former politician.

Sometimes, entrepreneurs get so caught up in serving clients, building their brand, and aiming for rapid growth that they overlook the crucial aspect of cash flow. However, neglecting this detail can leave them vulnerable when their business faces unexpected slumps.

Cash flow forecasting may sound old-fashioned, but it’s incredibly important for SaaS businesses. It gives you a clear understanding of where you’ve been, where you stand today, and what you need to reach your future goals.

We hope this article has helped you grasp the basics of cash flow projection and prepared you to tackle this fundamental challenge. If you’re new to the SaaS industry or need assistance with software development, Finoit Technologies, a top custom software development company, is here to help. They have the expertise and experience to address all your concerns and provide tailored solutions for your specific needs. So why wait, connect with our development expertise and address all your issues